Prosperity Watch (Issue 72, No 3)

April 18, 2017

Changes to North Carolina’s tax system in recent years have had an impact on the level of available revenue for public investments and shifted tax responsibility among taxpayers. BTC analysis has already noted how the tax chances since 2013 have delivered a significant share of the net tax cut to the state’s highest income earners while reducing revenue by nearly $2 billion annually. Consequently, this outcome undercuts the state’s ability to invest in the foundations of a strong economy.

New analysis by the Institute on Taxation and Economic Policy (ITEP) provides an assessment of the impact of tax changes since 2013 on racial and ethnic equity. The findings confirm that not only have the tax changes held in place systems that solidify income inequality, but they also reinforce systemic racism that excludes racial and ethnic groups from the path to upward economic mobility—such as access to good-paying job opportunities, home ownership and quality public education—by delivering the greatest share of the net tax cut to white, non-Hispanic taxpayers and undercutting public investments.

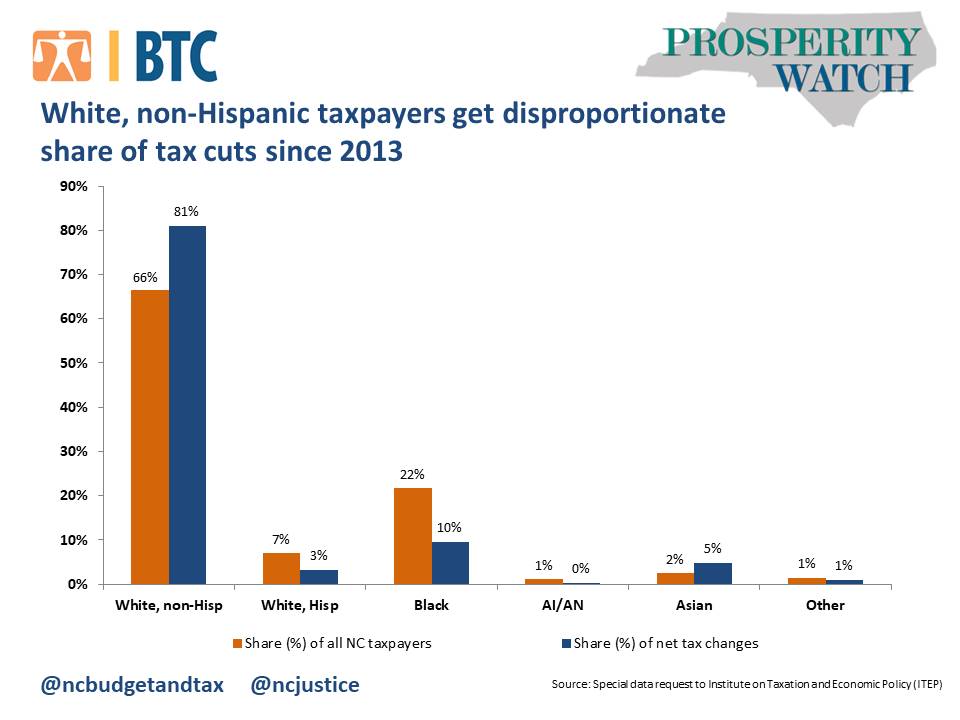

A disproportionate share of the net tax cut flow to white, non-Hispanic taxpayers at the expense of other racial and ethnic taxpayer groups. ITEP’s analysis finds that 81 percent of the net tax cut goes to white, non-Hispanic taxpayers, despite this group of taxpayers representing two-thirds (66 percent) of North Carolina taxpayers. By contrast, only 19 percent of net benefits go to non-white taxpayers, despite these taxpayer groups representing 34 percent of all taxpayers.

Among non-white taxpayers, Black taxpayers represent around 22 percent of all NC taxpayers, but get only 10 percent of the net tax cut since 2013. Furthermore, white, Hispanic taxpayers represent 7 percent of NC taxpayers but get only 3 percent of the net tax cut. Overall, Asian taxpayers are the only group other than white, non-Hispanic taxpayers that get a higher share of the net tax cut relative to their respective share of all North Carolina taxpayers – Asian taxpayers’ share of the net tax cut is 2 percentage points higher than the group’s share of taxpayers.

Recent tax cuts have reduced the state’s ability to invest in all of our communities and further set the state back from achieving greater equity in economic outcomes across racial and ethnic groups. Continuing to systemically exclude non-white North Carolinians from the opportunity to secure good paying jobs, accumulate assets and experience upward social and economic mobility will limit the long-term economic success for North Carolina as a whole.

Justice Circle

Justice Circle