2021 Budget Analysis

- Final budget cuts North Carolinians’ priorities while keeping them out of the process

- Four takeaways from the House budget proposal

- Five takeaways from the Senate’s budget proposal

- Four important takeaways from the Governor’s budget proposal

2021 Budget Analysis

Budgets Matter

- The Budget Story: Public health investments support people’s well-being

- The Budget Story: Transportation infrastructure connects people, business, and communities

- The Budget Story: Early childhood investments would support children’s development, parents’ return to work

- The Budget Story: Affordable housing investments could provide stable, safe homes in every community

- The Budget Story: Smart public investments can ensure access to justice and safety for all

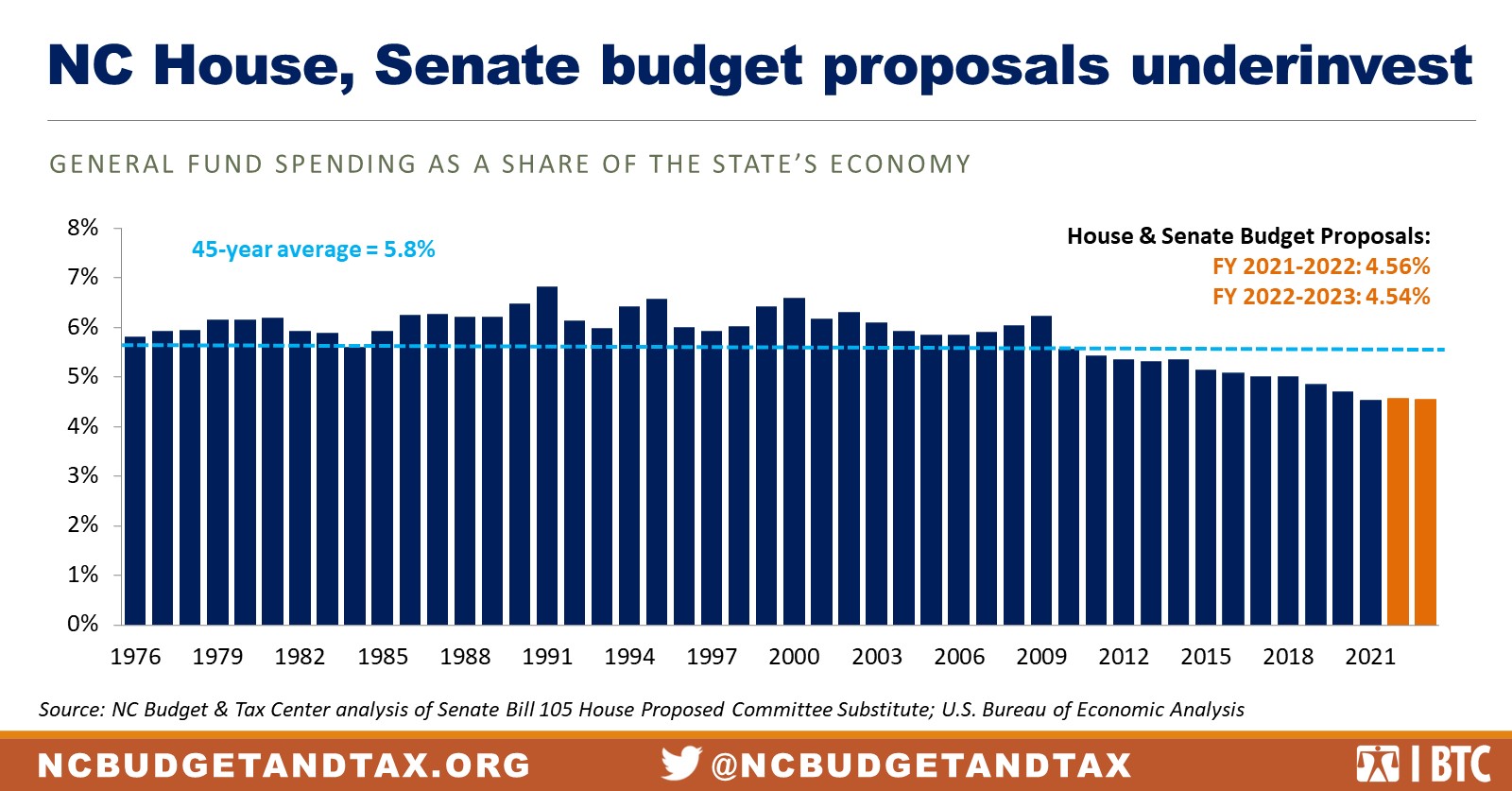

Tax and spending decisions made by North Carolina lawmakers have implications for everyday North Carolinians. Choices in recent years to cut taxes and enact budget cuts have reduced our state’s resiliency, the well-being of people and the economic stability and mobility of communities.

Public dollars can play a powerful role in addressing persistent challenges in our economy and democracy, however limiting public investments hampers our collective well-being.

Public investments work to support the economy in the near and long term by increasing human and physical capital. Investments in roads and bridges, education and research, and public services and infrastructure reaches every community in our state and ensures that all families have the resources they need to thrive.

Public investments connect more people to opportunity, bringing new ideas and talent to the economy and ensuring those already well-off aren’t hoarding opportunity for themselves. Research into social spending by OECD countries demonstrates that public investments can play a large role in fighting inequality. Closer to home, recent analysis of the power of public investments to fight hardship estimate a significant reduction in child and overall poverty rates from the federal spending through provisions in the American Rescue Plan aimed at providing cash and near-cash supports to children and families.

Public investments are broadly supported when made to advance the well-being of all. In North Carolina, support for targeted public investments are strong across a range of voters—a recently conducted public poll by Data for Progress found that 61 percent of North Carolinians sampled agreed that state policies should prioritize investing in low-income communities and communities of color.

Targeting public investments today to meet persistent challenges in our communities can go a long way to building back to an inclusive economy in North Carolina that supports the well-being of every person — Black, brown and white.

Budget Fact Sheets on COVID-19

Read the fact sheets and download the PDFs at these links.

- Fiscal Facts: The 101 on education needs that North Carolina should be funding during the pandemic

- Fiscal Facts: The 101 on hunger needs that North Carolina should be funding during the pandemic

- Fiscal Facts: The 101 on housing needs that North Carolina should be funding during the pandemic

- Fiscal Facts: The 101 on health needs that North Carolina should be funding during the pandemic

- Fiscal Facts: The 101 on child-care needs that North Carolina should be funding during the pandemic

The state budget. Our state budget represents our values in practice. It sets priorities for our communities and impacts our quality of life. And we need a state budget that reflects our communities’ needs and builds thriving communities.

Download our budget handbook. “Dollars & Democracy: How the state budget can build thriving communities” will explain how the budget sets priorities for our communities and impacts our quality of life and will also tell you how you can make sure your community’s needs are reflected in the state budget.

For information on prior North Carolina budgets, visit our archives here.

ABOUT OUR STATE BUDGET WORK

The state budget is a reflection of North Carolina’s values and commitment to supporting economic opportunity and investing in the state’s future. The Budget and Tax Center produces rigorous analysis of state budget proposals to determine if they adequately fund public structures and services, particularly those that promote shared prosperity, quality education, and healthy communities.

- Public Investments – Every year, the Budget and Tax Center produces a report on each of the state budget proposals—from the governor, the NC House and the NC Senate—and one on the final budget. We analyze the budgets to determine if they make adequate investments in education, health and human services, the courts and public safety, transportation and the environment. Legislators often refer to our analyses during budget debates, and public officials and progressive organizations throughout the state rely on our reports to help them understand the state budget and what it means for their communities and issue areas.

- Fiscal Responsibility – The Budget and Tax Center is the only research organization that looks not only at what investments the state is making but also how it pays for them. In addition to our tax analysis, we look at how decisions about savings, fund transfers, and the use of one-time money affect the state’s long-term fiscal health. The Budget and Tax Center also monitors the transparency and accountability of the budget process.

- Human Impacts – The budget makes a difference in our everyday lives and the vibrancy of our communities. The Budget and Tax Center works to engage with communities on the budget and its impacts and monitor and document how it is affecting North Carolinians.

Justice Circle

Justice Circle