Senate’s budget introduces more tax cuts for businesses, leaving funding inadequate to meet needs across a range of priorities for North Carolina.

The total biennial budget proposed last month by the North Carolina Senate falls in line with the house proposal, but substantial differences exist between the two, including tax law provisions and cuts to essential programs that the house proposal did not include.

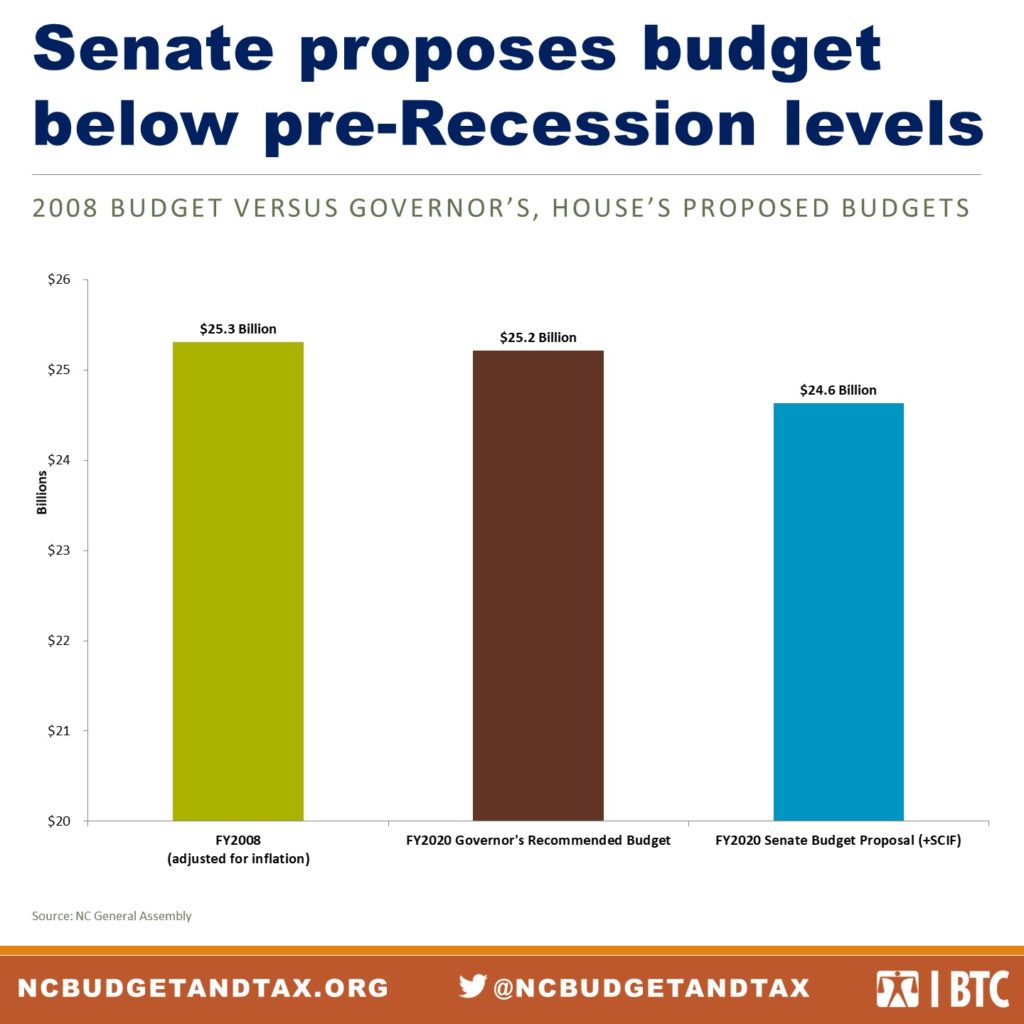

Together with funds statutorily committed to the State Capital and Infrastructure Fund (SCIF), which are not reflected in the total budget amount, the $24.6 billion budget is nearly 3 percent higher than the FY 2019 Budget that runs out this July.1 However, that increase doesn’t make progress toward pre-Recession funding levels — the current proposal is 5.5 percent less than the pre-Recession budget — nor does it meet identified needs in the areas of early childhood, healthcare, education, and environmental protection.

Senate leadership’s decision to limit public investments is holding North Carolina back from making progress on key measures of well-being and competitiveness, including our ability to prepare young people to reach their full potential and ensure all of our communities remain connected to the concentrated areas of job growth in the state.

Declining commitment to public good undercuts the foundation of a strong economy

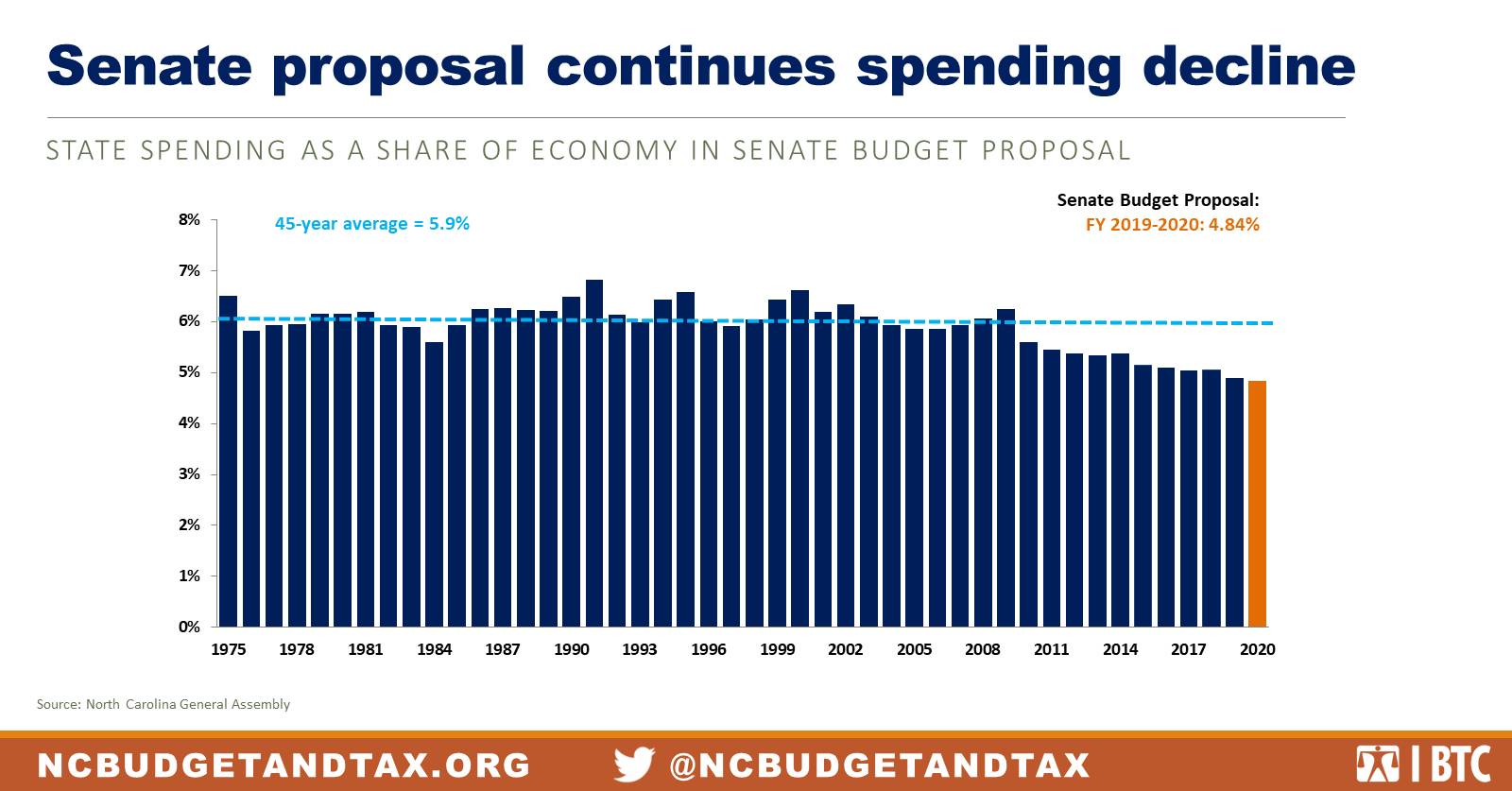

Public investments play a foundational role in economies by providing the necessary investments to connect people to jobs, business to markets and new research, and communities to the tools that promote health and well-being. State spending, while declining in downturns, has tended to make up that lost ground in good times and has remained steady at roughly 6 percent of total State Personal Income.

Public investments play a foundational role in economies by providing the necessary investments to connect people to jobs, business to markets and new research, and communities to the tools that promote health and well-being. State spending, while declining in downturns, has tended to make up that lost ground in good times and has remained steady at roughly 6 percent of total State Personal Income.

The Senate budget, however, continues to reduce spending as a share of the economy, undercutting the foundation of opportunity today and the infrastructure to support more sustained and broadly shared growth. The Senate proposal would reduce state appropriations to 4.84 percent of State Personal Income, more than a full percentage point below the historic average. Given that the state continues to benefit from the national expansion, the decision to hold spending low is not the result of an economic downturn but instead is the result of the General Assembly’s commitment to tax cuts since 2013.

The annual cumulative reduction in revenue from major tax changes since 2013 will mean at least $3.6 billion less in revenue each year.2 The rate reductions to personal and corporate income tax rates that went into effect on Jan. 1, 2019, resulted in a reduction in state revenue of $900 million.3

With the new tax cuts for businesses included in the Senate budget, even fewer dollars will be available each year for areas such as early childhood education, protecting natural resources like our drinking water, and ensuring that families struggling to get ahead have access to the supports to do so.

The Senate budget must hold spending down because the tax code alone isn’t keeping up with the needs of a growing population

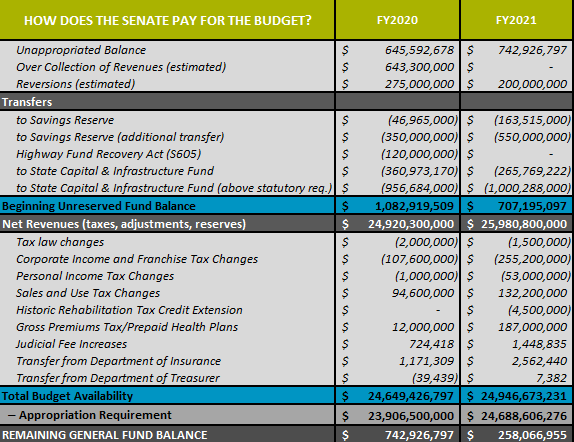

The Senate budget relies, like the House, on unappropriated balances from prior years and agency reversions to fund future services with the dollars that were set aside because services were underfunded or not expended in the prior year. The budget proposal also balances using the over-collection of revenues that economists with the Fiscal Research Division and the Office of State Budget and Management have determined are one-time in nature and largely driven by capital gains tax collections coming in higher than anticipated.4

Baseline revenues continue to grow at the modest rate of 4.3 percent year over year in the two-year budget, a conservative estimate of the growth that would usually be expected during an economic expansion and one that remains below the historic performance of the state tax code.5

Given commitments made in statute, the Senate leaders make commitments to transfer funds to various purposes. These required transfers take $528 million out of the General Fund even before consideration of the broad range of community needs. The state’s Rainy Day Fund and SCIF funds are set aside at the beginning of the budgeting process. While they are effective in ensuring that funds are available, they exert further pressure to keep spending low in other priority areas when in combination with tax cuts. Senate leaders have dedicated revenue over-collections and unappropriated balances to make additional transfers to the Rainy Day Fund and SCIF, which is prudent given their one-time nature.

The Senate budget makes worse the already upside-down tax code that places a heavier tax load on those with low incomes

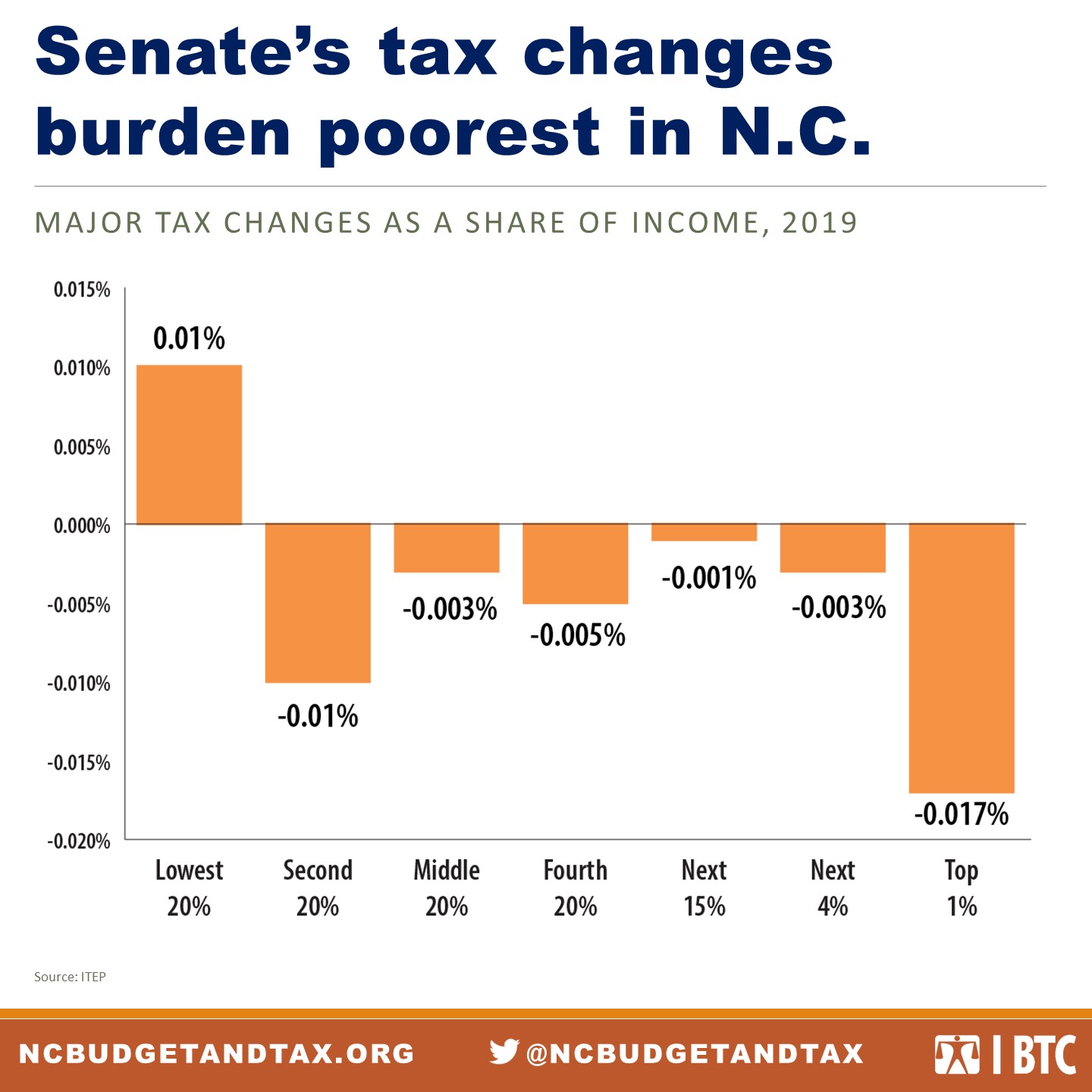

The tax changes included in the Senate budget will not fix the upside-down tax code. Indeed, on average, the changes will make it slightly worse.

Notably, the largest tax change in the Senate budget proposal is a reduction to the franchise tax rate that is even bigger than what was proposed by the House. The majority of franchise tax collections come from businesses with net worth above $20 million.6 This change will not only deliver the vast majority of the total tax cut from this provision to shareholders, but an estimated 80 percent of the tax cut will flow to taxpayers out of state.7

At the same time, the Senate budget would raise the standard deduction for taxable personal income subject to the income tax, a benefit to the nearly 80 percent of North Carolina taxpayers who don’t itemize. The standard deduction increase would result in a maximum tax cut of $53 for taxpayers who are married filing jointly.8 Importantly, this increase in the standard deduction is roughly offset by the collection of online sales tax as required by the Wayfair decision and other changes to sales tax in the proposed bill.

The graph above shows the impact of all major tax changes to North Carolina taxpayers. Millionaires — those taxpayers who are in the top 1 percent — would receive a tax cut, on average, of $245, reflecting 0.02 percent of their annual income. Taxpayers living on a poverty income of less than $22,000 would see their taxes increase on average by $1.9

A series of additional tax changes are included in the bill with more limited fiscal impacts, but they have important implications for the simplicity and equity of the tax code. For example, certain businesses would be able to deduct from their taxable income the dollars received from the state in the form of economic development incentives. Sales tax breaks for the aviation and motorsports industry were extended, as were tax breaks for historic preservation. Another provision would ensure that businesses working on disaster recovery projects would not have to pay taxes.

The continued tax cuts — and stated goal by Senate leaders of outright elimination of the franchise tax — has failed to recognize the primary purpose of a tax code: to fund public services. North Carolina could better meet the needs of a fast-growing state and render its tax structure less regressive by re-introducing a graduated personal income tax rate that features marginal tax rates — which rise based on increased ability to pay — and by raising corporate tax rates back up to match rates in neighboring states.

Greater cuts and inadequate investments are of particular concern in several budget areas

The Senate budget, like the House budget, holds spending low relative to historic levels but also proposes deeper cuts to priority areas for North Carolina.

- The Senate plan allocates modest funding for K-12 education, including additional school staff, classroom supplies, and teacher pay. However, the plan fails to account for the unmet needs due to years of underfunding that have led to too few teachers and support personnel, as well as inadequate school infrastructure.10 The senate budget would keep the state’s per-student investment at $119, below pre-Recession levels after adjusting for inflation.

- Even more so than the house version, the Senate budget’s Early Childhood funding decreases state funds and replaces them with federal block grant funds, particularly for the N.C. Pre-K program. This increasing reliance on federal TANF (Temporary Assistance for Needy Families) dollars, when they are available, rather than using those dollars in addition to state investments, results in no net increase in the number of slots available to eligible children.

- Existing Medicaid services receive significant funding cuts in the Senate budget and, compounded with the lack of medicaid expansion, put at risk the health of North Carolinians. By reducing funds for administrative costs, in particular, the core programming across the department of Health and Human Services may become compromised, in addition to the management cuts to the Division of Health Benefits itself. The Medicaid program under the Senate budget would be funded below the Governor’s budget proposal by approximately $100 million in year one.

- Raise the Age, which begins implementation later this year, is based on legislation enacted in 2017 in North Carolina that would divert 16- and 17-year-olds charged with non-violent crimes to the juvenile justice system rather than charging them as adults. Adequate funding is necessary for successful implementation of the legislation and included programs, in order to maximize the impact and meet the needs of justice-involved youth. While the N.C. legislature appointed a committee to determine funding and other requirements necessary for full implementation, the Senate budget allocations come up short by $36.7 million in the first budget year alone.

Footnotes

- Budget and Tax Center analysis of the 2019-2021 Proposed Senate Committee Substitute, May 29, 2019. Retrieved from https://www.ncleg.gov/Sessions/2019/Budget/2019/Committee_Report_Senate_Appropriation_Base_Budget_PCS_May_29_2019.pdf

- Johnson, Cedric. (2017). Costly Tax Cuts in New State Budget Continue Precarious Road Ahead for North Carolina. Retrieved from https://www.ncjustice.org/publications/costly-tax-cuts-in-new-state-budget-continue-precarious-road-ahead-for-north-carolina/

- Sirota, Alexandra Forter. (2018). Revenue options to support children’s educational success. Retrieved from https://www.ncjustice.org/publications/revenue-options-to-support-childrens-educational-success/

- Sirota, Alexandra. (2019). NC tax collections likely to exceed projections, but leaders should proceed with great caution. Accessed at http://pulse.ncpolicywatch.org/2019/05/08/nc-tax-collections-likely-to-exceed-projections-but-leaders-should-proceed-with-great-caution/

- North Carolina General Fund Revenue Consensus Forecast–May Revision. (2019). Accessed at https://www.ncleg.gov/FiscalResearch/generalfund_outlook/19-20/Revised%20Consensus%20Forecast%20May%202019.pdf

- Sirota, Alexandra. (2019). Reform — don’t eliminate — the franchise tax. Accessed at https://www.ncjustice.org/publications/reform-dont-eliminate-the-franchise-tax/ and North Carolina Department of Revenue, Tax Year 2016. Corporation Income and Business Franchise Taxes: Statistics and Trends. Accessed at: https://files.nc.gov/ncdor/documents/reports/corpandfran16.pdf

- Special Data Request, Institute on Taxation and Economic Policy, June 2019

- Legislative Fiscal Note, North Carolina General Assembly, Session 2019. Accessed at https://www.ncleg.gov/Sessions/2019/FiscalNotes/House/PDF/HFN0966v5.pdf

- Special Data Request, Institute on Taxation and Economic Policy, June 2019.

- Nordstrom, Kris. (2019). Senate education budget is a dereliction of duty. Retrieved from http://pulse.ncpolicywatch.org/2019/05/30/senate-education-budget-is-a-dereliction-of-duty/

Justice Circle

Justice Circle