Corporations are often at the center of conversations about job creation and taxes in our country today. As many economists have pointed out, however, a corporation’s role in driving job growth and contributing to the well-being of communities is far from guaranteed. Indeed, a well-documented shift in the way corporations orient their efforts towards shareholders and away from their employees, communities, and the broader health of the market is making it more difficult to ensure a clear line between the well-being of corporations and that of people and the economy.

Recent federal tax changes have provided additional evidence of how corporations deliver disproportionate benefits to shareholders. Through the Tax Cuts and Jobs Act passed by Congress and signed by President Trump in December, corporations will receive a reduction on their statutory tax rate from 35 to 21 percent. Many corporations will pay less than the statutory rate than they did before the law passage—24 percent on average compared to 35 percent—due to loopholes and tax breaks. Some will pay no taxes at all.

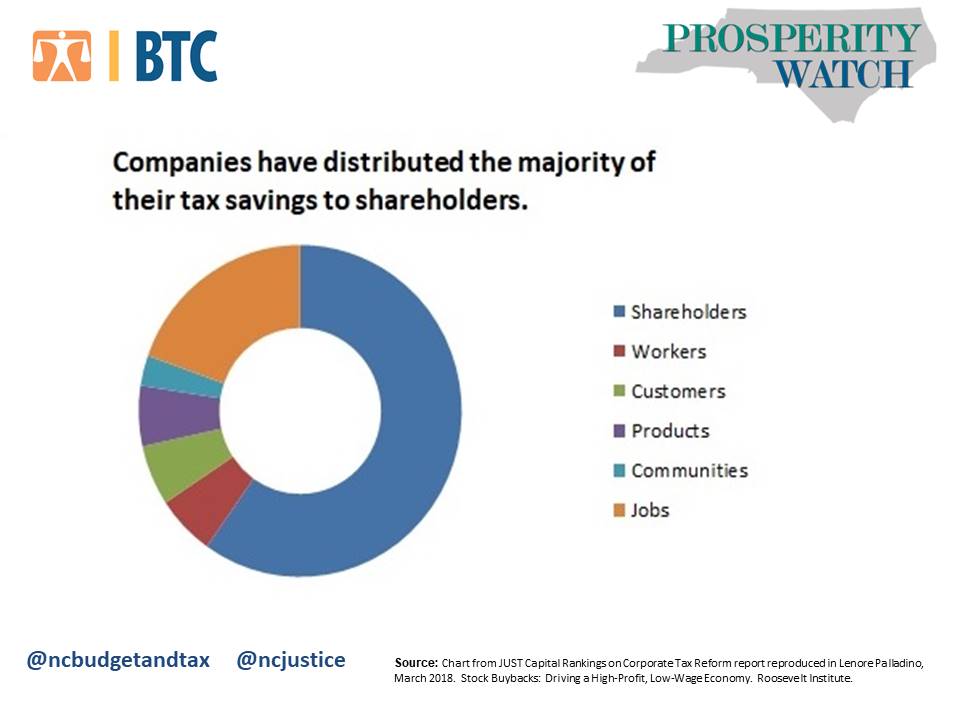

Roughly 61 percent of the total $150 billion in tax savings for these companies will be delivered to shareholders, according to JUST Capital of the Russell 1000 companies. These findings are consistent with other analysis since the federal changes took effect in January. This delivery will take the form of direct distribution to these individuals, retained earnings, and stock buybacks. The latter is an increasingly common practice by corporations after rule changes in the 1980s allowed companies to buy back their own stock, thus inflating the price of their shares without necessarily committing to investments that would change the underlying value of the company.

In North Carolina, corporations are already benefiting from rate reductions made to the state corporate income tax rate since 2013. At that time, roughly 8 percent of businesses operating in the state were subject to the statutory corporate income tax rate of 6.9 percent. Estimates at that time found that of the 14 Fortune 500 companies in North Carolina none were paying the statutory tax rate: 11 paid less than 5 percent and three paid no taxes at all.

This year North Carolina’s corporate income tax rate is 3 percent or less than half what it was before the tax cuts. It will drop again to 2.5 percent in January 2019 even as corporations receive the additional federal income tax cut.

Justice Circle

Justice Circle