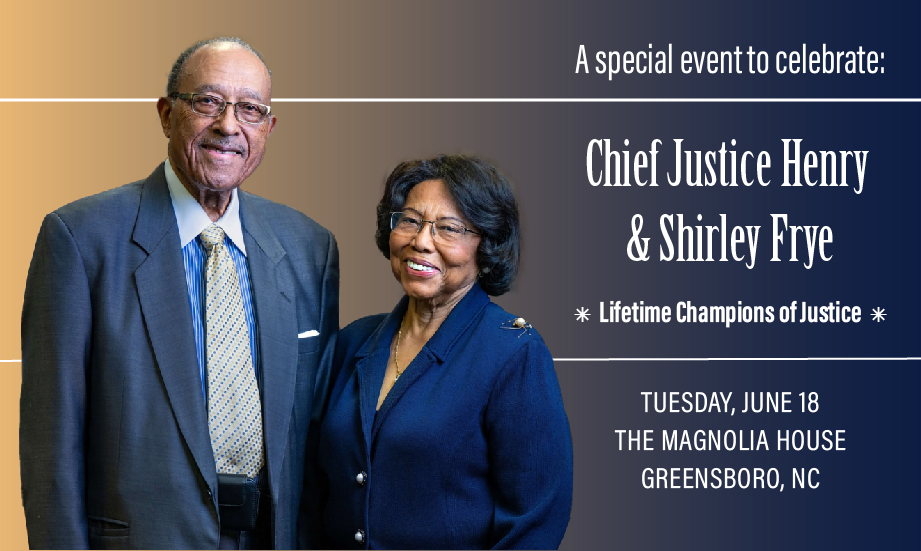

Join us for the 2024 Greensboro Champion of Justice Reception

Click here to learn more and become a sponsor

April is Second Chance Month

Help us fight for fair chances in NC

Settlement approved for residents of mobile home park in Garner

Garner residents to be compensated by Riverstone Communities, LLC

Welcome to the North Carolina Justice Center

Our mission is to eliminate poverty in North Carolina by ensuring that every household in the state has access to the resources, services, and fair treatment it needs to achieve economic security.

Explore Projects

Latest News

View All NewsUpcoming Events

A great resource to help educate North Carolina voters and policy leaders. The Center promotes advocacy for equitable solutions to real issues faced by the state.

Justice Circle

Justice Circle