The NC Justice Center is not part of or affiliated with North Carolina’s government and agencies. If you have any questions or concerns about your payment, contact the NC Department of Revenue directly at 1-877-252-3052. Alternatively, contact ncecg@charlottelegaladvocacy.org or call at 1-888-301-1555 for assistance.

As North Carolina works to recover from the COVID-19 recession and rebuild our economy, direct cash assistance can provide critical financial support, boost aggregate consumer demand, and improve the well-being of families and communities. To be effective, cash assistance programs should target families with the greatest need and leverage the existing public infrastructure. Unfortunately, flaws in the design of North Carolina’s Extra Credit Grant Program are preventing thousands of families with children who are living in poverty from receiving the financial support they need now.

The NC Extra Credit Grant Program was created in September with federal Coronavirus Relief Funds — nearly all of the CRF dollars that remained — to help parents with the cost of virtual learning and child care. According to the new law, each eligible household with a qualifying child should receive a $335 grant. Up to $5 million was allowed to be used for administration of the program.

Eligibility

To automatically receive the grant, households must have filed a 2019 state income tax return, lived in North Carolina for all of 2019, and reported at least one qualifying child on their taxes.

Legislative sponsors indicated on the floor of the General Assembly that grants should be phased out for people who filed single with more than $200,000 in annual income and people who filed jointly with more than $400,000 in annual income. Even if grants were phased out in accordance with the federal child tax credit, about 25 percent of the total grants expected to be distributed would go to households with annual incomes of $100,000 or more.

Administration

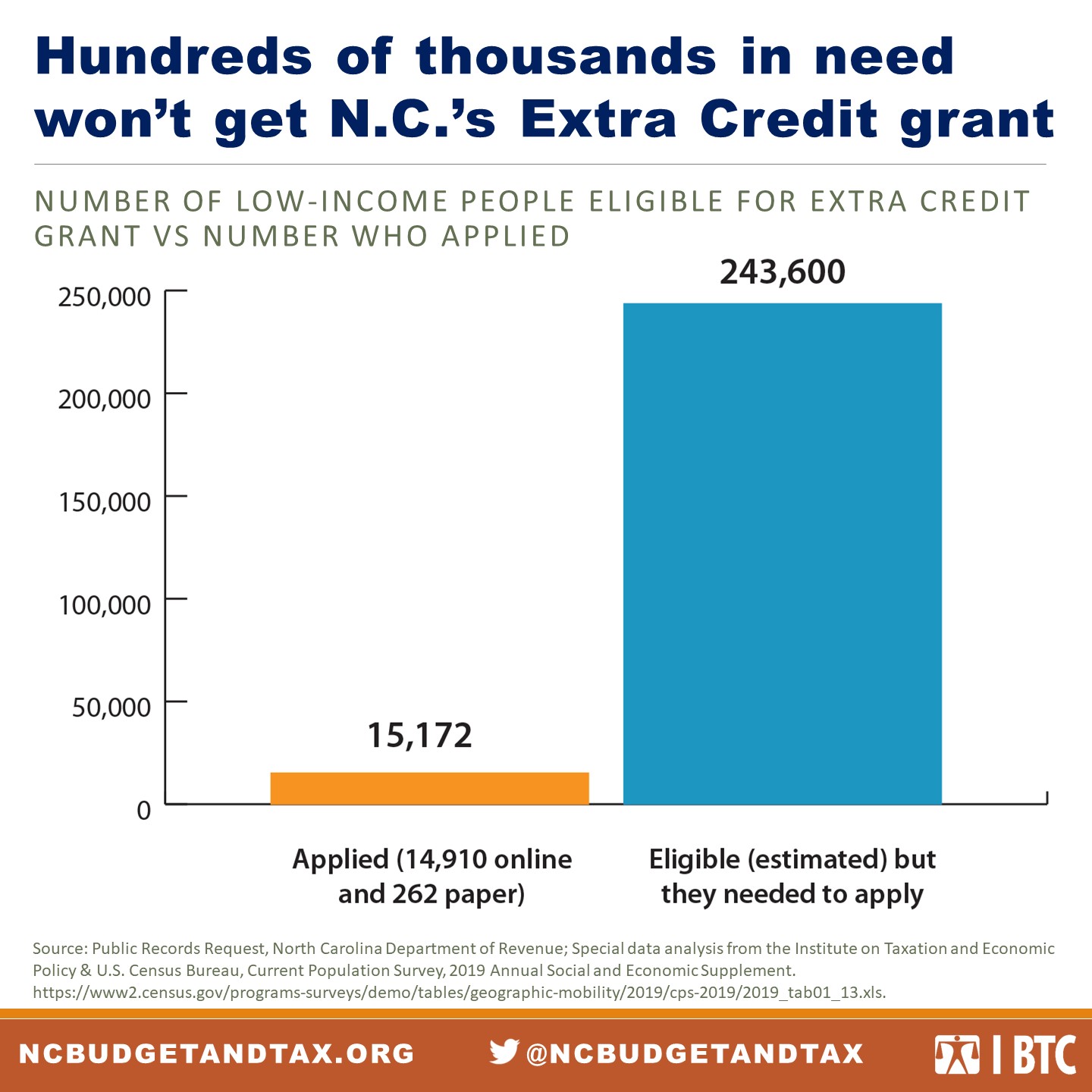

Because the state chose the North Carolina Department of Revenue (NCDOR) as the state agency to administer the program, people who were not required to file state income taxes because they did not make enough money in 2019 had to apply separately to receive the grant. NCDOR made online and paper applications available from Sept. 17 to Oct. 15, 2020, but despite some advertising about the program, only a small fraction of eligible families applied for the grant before the deadline.

Result

By estimation, well over 200,000 families were likely eligible for the Extra Credit Grant, but they needed to apply before the Oct. 15 deadline. According to NCDOR, there were 14,910 online applications and 262 paper applications, which means only about 6 percent of the eligible families successfully applied.

The stated purpose of the Extra Credit Grant Program was to provide “economic support to assist with virtual schooling and child care costs during the COVID-19 pandemic” for families with children. Flawed policy design, poor targeting, and arbitrary deadlines have prevented hundreds of thousands of North Carolina families from accessing the financial support they needed most.

Direct cash assistance can be an efficient and effective way to assist families that face barriers to economic security. Getting emergency money to people experiencing a crisis also helps to boost the economy by ensuring that people can pay for the goods and services they need. Filling the holes in our social safety net and ensuring that families with the greatest need can access public services and supports will pave the way toward economic recovery and help North Carolina build back better.

Policy Recommendations

The road to economic recovery requires robust and targeted interventions from federal, state, and local governments. Leveraging existing public infrastructure will help target and place dollars in the hands of people who need it most. The North Carolina Department of Health and Human Services is an ideal home for targeted cash assistance programs because the department already maintains databases and administers programs to help families access anti-poverty support. Bolstering existing programs like the state’s Work First program, also known as Temporary Assistance for Needy Families (TANF), by increasing cash assistance payments and removing barriers for families seeking to access the program would go a long way toward helping families with the most urgent needs.

A refundable state Earned Income Tax Credit would reach a broader group of working families who have been hit hard by COVID-19 and provide cash assistance leading to increased economic security for all.

Justice Circle

Justice Circle