Greener roads for all: Making EVs work for every community

Learn more about the Equitable EV Framework

Welcome to the North Carolina Justice Center

Our mission is to eliminate poverty in North Carolina by ensuring that every household in the state has access to the resources, services, and fair treatment it needs to achieve economic security.

News & Commentary

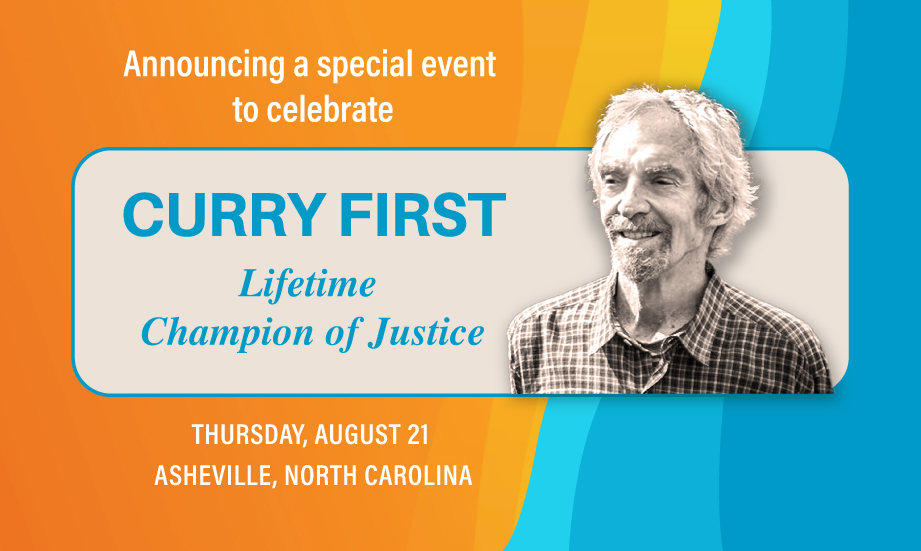

Upcoming Events

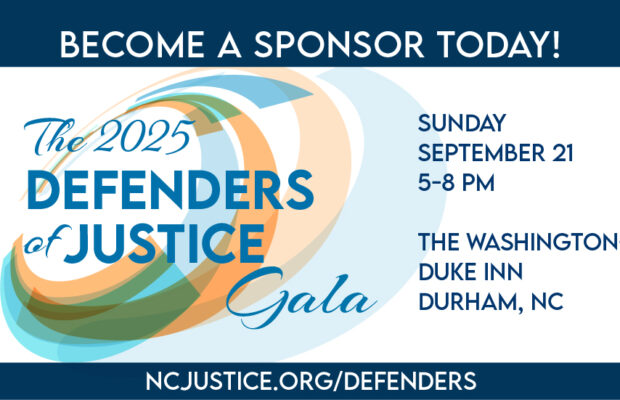

2025 Defenders of Justice Gala

The Washington Duke InnExplore Projects

A great resource to help educate North Carolina voters and policy leaders. The Center promotes advocacy for equitable solutions to real issues faced by the state.

Justice Circle

Justice Circle