Prosperity Watch, Issue 88, No. 3

(July 16, 2018)

In a time of widening income inequality, a new report from the Institute on Taxation and Economic Policy finds that the federal tax code has boosted the income of the highest-income households since 2000.

Tax policy has a powerful role to play in addressing income inequality by ensuring that the contributions made by taxpayers align with their ability to pay, by minimizing the tax load on people living in poverty, by keeping up with where income is growing in the economy, and by funding the systems and services that boost more people’s connection to economic opportunity. However, the recent history of tax choices points to its contribution to the growing divide between the top 1 percent and everyone else, rather than to a design that would boost the economic well-being of all in our country.

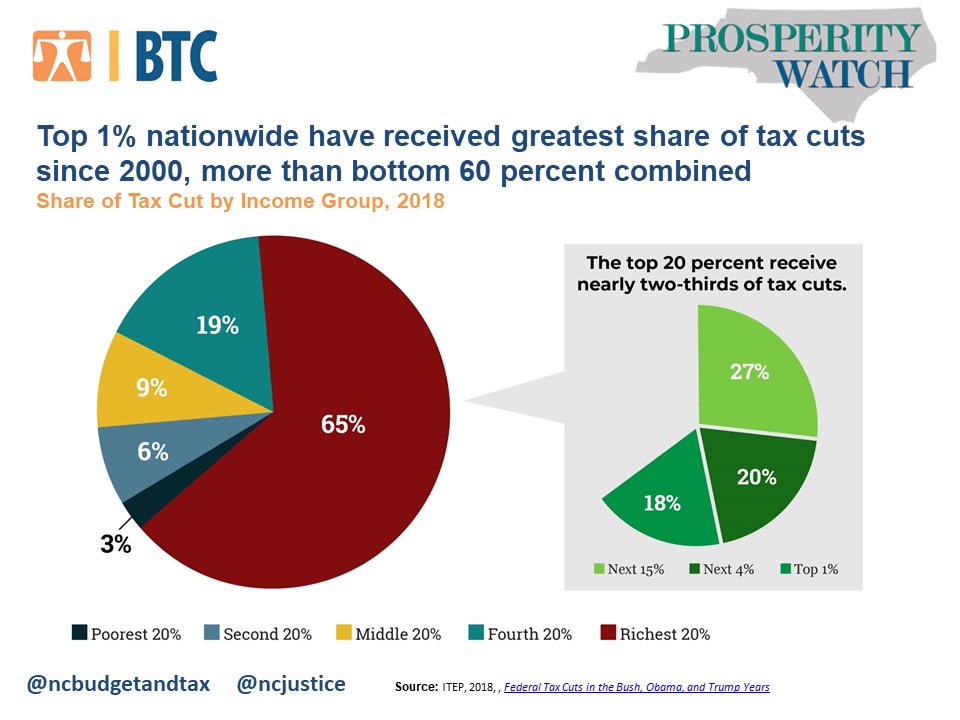

In this latest report from ITEP, researchers found that from 2001 through 2018, significant federal tax changes have reduced revenue by $5.1 trillion, with nearly two-thirds of that flowing to the richest fifth of Americans. Most notable is that the top 1 percent of taxpayers received a greater share of the net tax cuts in this period than the bottom 60 percent.

Justice Circle

Justice Circle